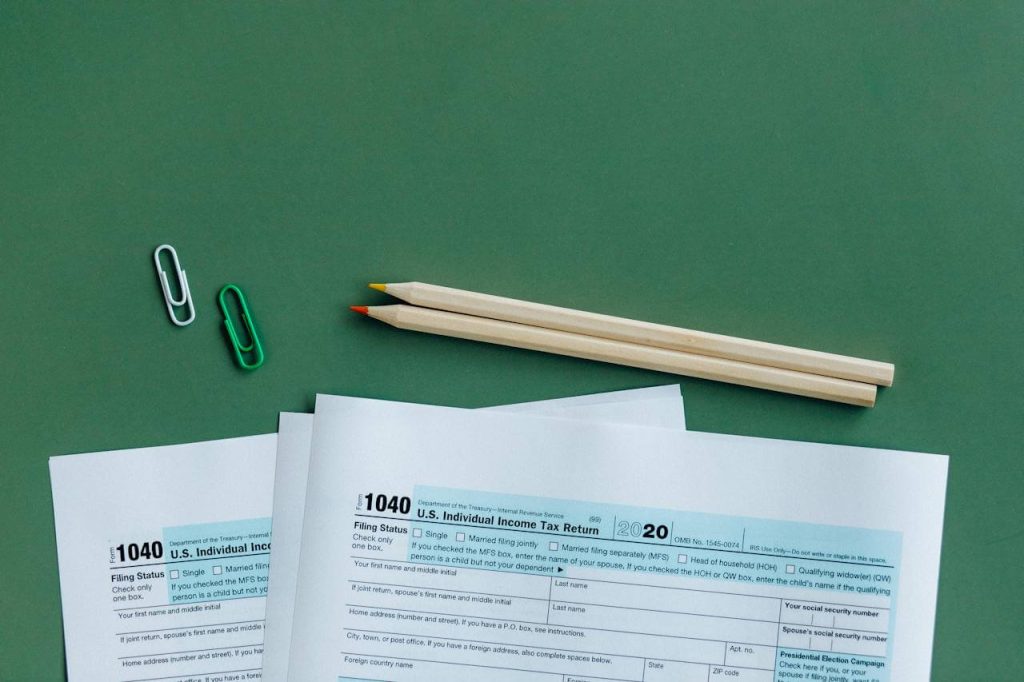

When a foreign company wishes to operate in Spain, one of the essential procedures is to obtain a Tax Identification Number (NIF). This code is necessary for any action with tax implications, such as opening bank accounts, issuing invoices or formalising contracts. In the process of obtaining the NIF, there are two key stages: the provisional NIF and the definitive NIF.

The provisional NIF is assigned by the Tax Agency after submitting the basic documentation of the foreign company, such as form 036, the company’s bylaws, the power of attorney and the identification of the legal representative (passport or NIE). This NIF allows the company to start operations in Spain immediately but on a temporary basis, until the Administration validates all the documentation. This is useful so as not to delay business activity while the procedure for obtaining the definitive NIF is completed.

The definitive NIF is the number that the Tax Agency issues once all the foreign company’s documentation has been reviewed and accepted. Unlike the provisional number, this is fully valid for legal and tax purposes, and will accompany the company in all its dealings in Spain, guaranteeing legal certainty and avoiding problems with the tax authorities, banks and suppliers.

The main difference between the two numbers lies in their validity and legal nature: while the provisional NIF allows you to operate temporarily, only the definitive NIF ensures the correct fiscal representation of the company in Spain. Therefore, it is very important to complete the process in order not to generate incidents in the company’s operations.

At Numo, we offer a comprehensive service to help all foreign companies to obtain their NIF in Spain. We take care of preparing the documentation, carrying out the necessary translations and legalisations, filing the 036 form with the Tax Agency and following up until the definitive NIF is obtained.

With our professional support, international clients can start their operations in Spain with complete confidence, avoiding errors and delays, and ensuring that their company complies with all tax obligations from the very beginning. Our agency in Madrid, located at Núñez de Balboa, 115 bis, combines experience, proximity and efficiency so that each procedure can be carried out and formalised quickly and securely.